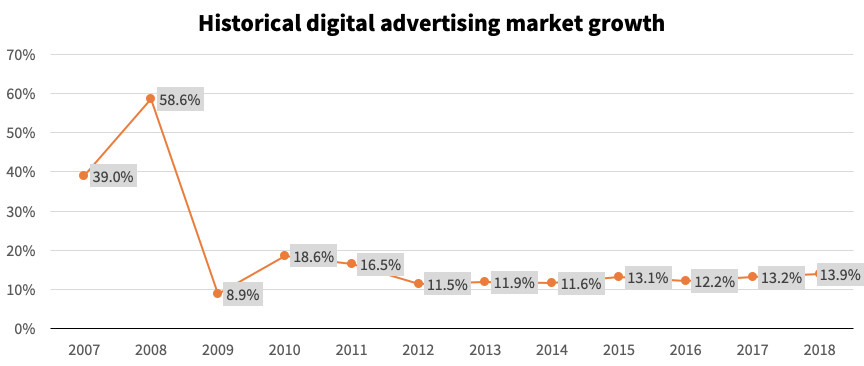

IAB Europe, the leading European-level industry association for the digital advertising ecosystem, announced at its annual Interact conference today in Warsaw that digital advertising grew 13.9 percent in 2018 to €55.1bn, driven by strong growth in video, mobile and social spend.

This is the fastest growth since 2011 and has seen the market more than double in size since 2012.

The AdEx Benchmark study is the definitive guide to the state of the European digital advertising market, covering 28 markets, and is now in its thirteenth year. In 2018, a total of twenty-one markets saw double-digit year-on-year growth

Out-stream video and mobile both dominated results in 2018, as they both grew by double-digits in all twenty-eight markets in the study. Out-stream video grew by 44.7 percent on average, compared to in-stream at 19.7 percent. Overall, video grew by 30.9 percent, to €7.6bn, accounting for 33 percent of the display market.

Search remains the largest online advertising category in terms of revenue with a growth of 12.5 percent and a market value of €25bn.

Social is fueling display growth across Europe, growing 33.7 percent year-on-year and now accounts for 49 percent of display.

Total mobile ad spend grew by 31.4 percent in 2018, to €22.8bn, and now accounts for 41 percent of all digital ad spend across Europe.

Commenting on the results, Townsend Feehan (CEO, IAB Europe) said: "It is encouraging to see such healthy, double-digit growth across the entire region, driven largely by mobile and video. The digital advertising industry now contributes €55bn towards European Gross Domestic Product and is adding value to both mature and emerging markets. With digital advertising now accounting for 45 percent of all paid media advertising across the region and new European data protection rules making users more aware of their choices about how their data is processed, it is important that we focus on delivering privacy-first ad experiences that protect consumers and support Europe’s digital economy".

The IAB Europe AdEx Benchmark study divides the digital ad market into three categories: Display, Search and Classifieds and Directories. Growth in these advertising formats has been underpinned by shifting uses in devices and changing consumption patterns. In 2018, Display has closed the gap with Search, growing by 17.5 percent to account for 42.2 percent of all spend.

Dr. Daniel Knapp (Chief Economist, IAB Europe) continued: "Mobile, video and social continue to drive growth across the region, with mobile now closing in on 50 percent of both display and search, and video accounting for a third of all display. These formats and environments reflect consumer engagement with a range of devices, for entertainment, utility and connection, demonstrating the diverse power of digital advertising to influence consumer decision-making."

In 2018, the top five largest growth markets all came from the CEE region:

- Ukraine – 26.9 percent

- Russia – 24.9 percent

- Belarus – 23.6 percent

- Czech Republic – 20.9 percent

- Serbia – 20.1 percent

Norway entered the top 10 in 2018, with further gains by Spain and Sweden.

Top 10 rankings (by market size)

- UK – €18.4bn

- Germany – €7.2bn

- France – €5.2bn

- Russia – €4.1bn

- Italy – €2.9bn

- Netherlands – €2.2bn

- Spain – €2.2bn

- Sweden – €2.1bn

- Switzerland – €2.0bn

- Norway – €1.1bn

The full AdEx Benchmark 2018 Report will be published towards the end of June 2019.

IAB Europe is the leading European-level industry association for the digital advertising ecosystem. Its mission is to promote the development of this innovative sector and ensure its sustainability by shaping the regulatory environment, demonstrating the value digital advertising brings to Europe’s economy, to consumers and to the market, and developing and facilitating the uptake of harmonised business practices that take account of changing user expectations and enable digital brand advertising to scale in Europe.

The data has been compiled by IAB Europe based on information provided by the national IAB offices around Europe. The report includes market size and value information for 2018 for the following markets: Austria, Belarus, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, the Netherlands, Norway, Poland, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, UK and the Ukraine. The data represents the calendar year 2018 January- December. This is the thirteenth AdEx Benchmark study which began in the calendar year 2006.

Display includes PC-based and mobile banners, rich media and video formats.

See further explanatory note on data below.

Each national IAB in Europe runs its own annual online advertising spending study and the IAB Europe AdEx Benchmark figures are based on these studies. As the methodology of the studies varies market by market, IAB Europe has defined methodology rules to represent the figures in such a way as to make them realistically comparable. This involves:

- Readjusting national figures to allow for harmonised representation. Readjustment rates are supplied by groups of national market experts

- Estimating/harmonising ad spend data for certain formats or segments in certain markets where national IAB studies do not include data or the definition or scope of a format is substantially different from IAB Europe standardised segments

- Where national data is collected in a currency other than Euros, the average exchange rate in 2018 has been used to convert this to Euros. To provide data for prior year growth rates, the prior year figures have also been re-calculated using a constant exchange rate in order to eliminate currency effects.

- AdEx Benchmark focuses on four normalised segments: ‘Display’ (including mobile display, rich media and video), ‘classifieds and directories’, ‘paid search’ and ‘other’ (including email but excluding email marketing).

- Figures quoted are gross figures (i.e. net invoiced value of the media, plus agency commission if any).

Data reported by national IABs is supplemented with data from company filings and econometric models.